The Role of Central Banks in Forex Markets

Central banks play a vital and often underestimated role in shaping the dynamics of the Forex market. Their influence extends far beyond national borders, impacting currency values and market sentiments worldwide. In this article, we will explore the significant role central banks play in the Forex market and how traders can leverage their policies for strategic advantage.

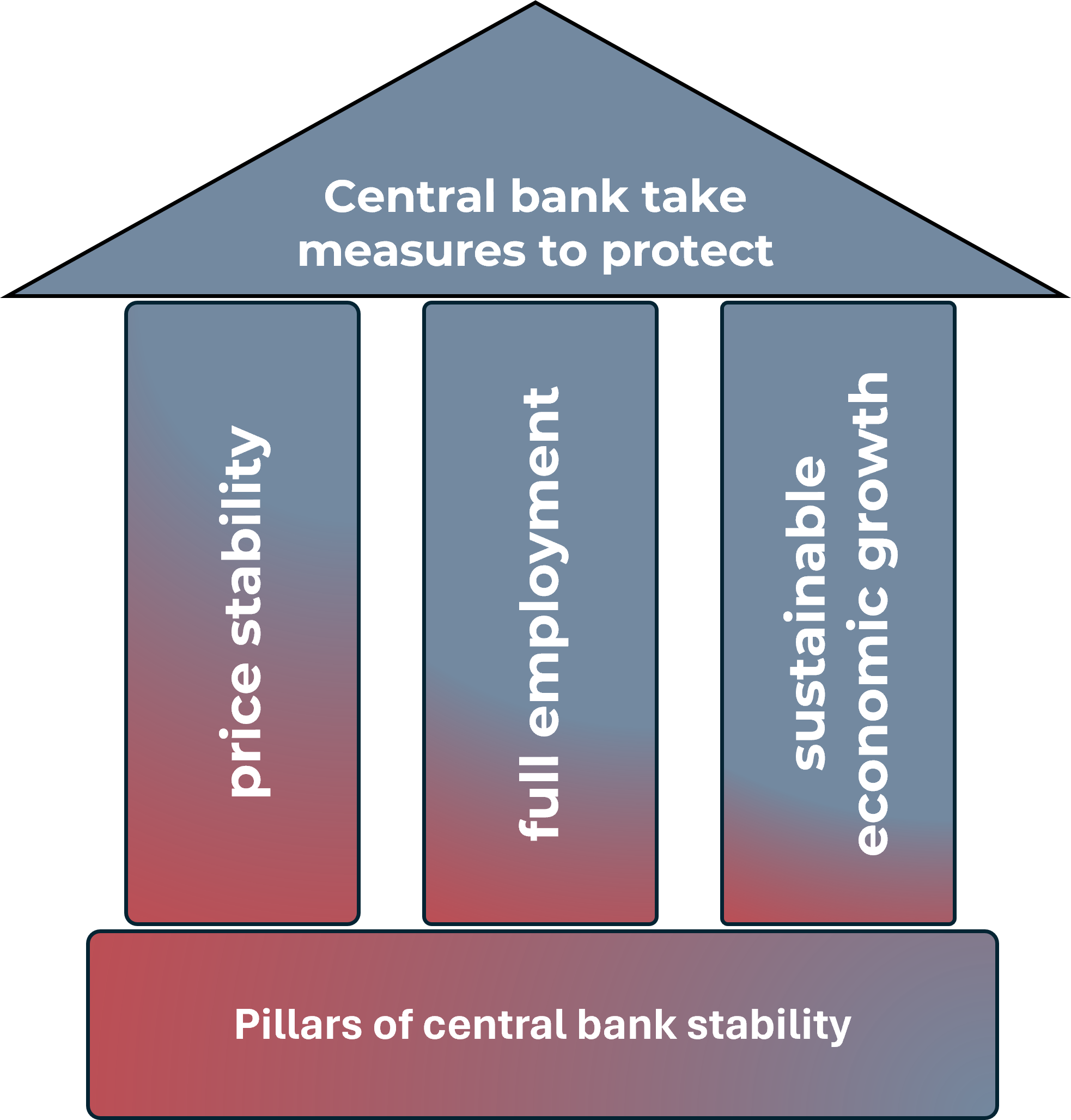

Understanding the Pillars of Forex Stability

At the heart of central banking lies the responsibility of maintaining economic stability within a nation. Through various monetary policy tools such as interest rate adjustments, open market operations, and reserve requirements, central banks aim to achieve key objectives like price stability, full employment, and sustainable economic growth. These measures not only impact domestic economies but also reverberate across global financial markets, particularly in the Forex arena where currencies are traded against each other.

Meet the Major Players:

Central banks are not created equal, and each major player carries its own set of responsibilities and priorities. The Federal Reserve Bank of the United States, commonly known as the FED, holds considerable sway over the world's reserve currency, the US dollar. Similarly, the European Central Bank (ECB) oversees the Eurozone's monetary policy, while the Bank of England and the Bank of Japan manage the British pound and the Japanese yen, respectively. These institutions, along with others, collectively shape the Forex landscape through their policy decisions and interventions.

Central Bank Policies: Unraveling the Threads of Forex Trends

One of the most critical tools in a central bank's arsenal is its ability to set interest rates. Changes in interest rates can have profound effects on currency values and market sentiments.

For example, when a central bank raises interest rates, it signals confidence in the economy's strength and aims to curb inflationary pressures. This can attract foreign capital inflows, leading to an appreciation of the domestic currency in the Forex market.

Conversely, lowering interest rates can stimulate economic activity but may lead to currency depreciation as investors seek higher yields elsewhere.

Impact on Forex Dynamics

Take, for instance, the European Central Bank (ECB) raising interest rates. Such a move not only reflects the ECB's assessment of the Eurozone's economic health but also signals its commitment to price stability. In response, Forex traders may adjust their positions, buying euros in anticipation of higher returns on Euro-denominated assets. This increased demand for the euro can drive its value higher relative to other currencies, creating trading opportunities for astute market participants.

The dynamics of the Forex market, particularly in Central and Eastern European (CEE) countries, are influenced by various factors, including central bank communications and macroeconomic announcements. The following information is based on the journal atricle of Balázs Égert, Evžen Kočenda (2014):

Central Bank Communications:

- Before March 2008, the Hungarian Central Bank maintained the forint within a 15% fluctuation band concerning the euro, expressing significant concern about the forint's exchange rate. The bank aimed to keep the forint stable relative to the euro, as highlighted by statements from central bank officials regarding defending the currency's stability.

- In Poland, central bank communications were frequent but distributed evenly among statements aiming to stabilize, weaken, or strengthen the zloty. Notably, attempts to weaken the zloty resulted in marginal appreciation instead, indicating a complex interplay between central bank intentions and market expectations.

Macroeconomic Announcements:

- Various macroeconomic announcements, such as CPI, PPI, GDP, and interest rate changes, significantly impact Forex dynamics. For instance, news about producer price inflation tends to strengthen the Czech and Polish currencies but has a counter-intuitive effect on the Hungarian forint, possibly due to its managed exchange rate regime with the euro.

- Improvements in current account balances lead to currency appreciation, while positive surprises in retail sales contribute to the appreciation of the Polish currency.

Overall Impact:

- Market expectations and reactions to both central bank communications and macroeconomic announcements play crucial roles in Forex dynamics. The stability of currencies, such as the Czech koruna and Hungarian forint, is influenced not only by central bank interventions but also by market confidence and international trade dynamics.

- During the crisis period of 2008–2009, the impact of central bank communications and macroeconomic announcements varied, reflecting the heightened uncertainty and economic challenges faced by CEE countries during that time.

Understanding the intricate interplay between central bank actions, macroeconomic indicators, and market expectations is essential for traders navigating the complex landscape of the Forex market in CEE countries.

Seizing Opportunities: The Carry Trade

Understanding the intricacies of central bank policies and their implications for the Forex market is essential for traders looking to navigate volatile market conditions successfully. By staying informed about central bank announcements, analyzing economic indicators, and anticipating policy shifts, traders can position themselves strategically to capitalize on market opportunities. Whether it's riding the waves of interest rate differentials through carry trades or interpreting central bank communications for trading signals, a nuanced understanding of central bank dynamics can empower traders to make informed decisions and achieve their financial goals in the Forex market.

How do you learn more about interactions? Take our trading coachings!

Cited: Balázs Égert, Evžen Kočenda (2014): The impact of macro news and central bank communication on emerging European forex markets, Economic Systems, Volume 38, Issue 1, 2014, Pages 73-88,ISSN 0939-3625, https://doi.org/10.1016/j.ecosys.2013.01.004.